What are certificates of deposit?

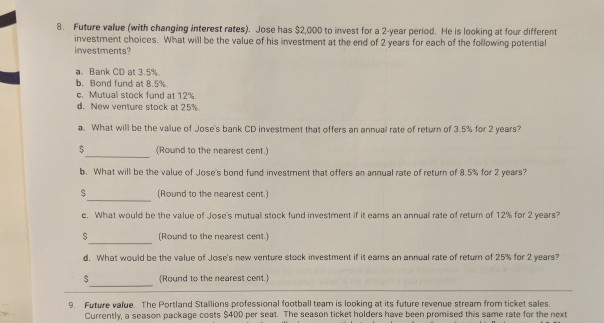

Certificates of deposit (CDs) make financial sense for people of all ages who want a low-risk investment to park cash they don’t plan to use immediately. Maybe you want to use your cash to buy a. Say your CD has a savings interest rate of 2%. This means your money will earn 2% by the end of the term. If you put $10,000 in a 1-year CD with a 2% annual interest rate, after one year, the $10,000 could. A CD is an interest-bearing certificate commonly offered by banks, savings and loans, and credit unions to raise money for their business activities. You deposit money with the issuer for a set time, and the issuer promises to repay you at a specified interest rate. You may want to consider investing in CDs. Certificates of deposit (CDs) are investments that help you grow your money safely, and using them can be as simple or as complicated as you want. If your needs are basic, it’s easy to put money into a CD. A certificate of deposit (CD) is a savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year, or five years, and in exchange, the issuing bank pays interest.

A certificate of deposit (CD) is a savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year, or five years, and in exchange, the issuing bank pays interest. When you cash in or redeem your CD, you receive the money you originally invested plus any interest. Certificates of deposit are considered to be one of the safest savings options. A CD bought through a federally insured bank is insured up to $250,000. The $250,000 insurance covers all accounts in your name at the same bank, not each CD or account you have at the bank.

As with all investments, there are benefits and risks associated with CDs. The disclosure statement should outline the interest rate on the CD and say if the rate is fixed or variable. It also should state when the bank pays interest on the CD, for example, monthly or semi-annually, and whether the interest payment will be made by check or by an electronic transfer of funds. The maturity date should be clearly stated, as should any penalties for the “early withdrawal” of the money in the CD. The risk with CDs is the risk that inflation will grow faster than your money, and lower your real returns over time.

Broker certificates of deposit

Although most CDs are purchased directly from banks, many brokerage firms and independent salespeople also offer CDs. These individuals and entities, known as “deposit brokers,” can sometimes negotiate a higher rate of interest for a CD by promising to bring a certain amount of deposits to the institution. The deposit broker can then offer these “brokered CDs” to their customers.

6% Cd Rates Fdic Insured

Thoroughly check out the background of the issuer or deposit broker to ensure that the CD is from a reputable institution. Deposit brokers are not licensed or certified, and no state or federal agency approves them. Since anyone can claim to be a deposit broker, always check whether the deposit broker or the company he or she works for has a history of complaints or fraud. Many deposit brokers are affiliated with investment professionals. You can check out their disciplinary history using the SEC’s and FINRA’s online databases. Your state securities regulator may have additional information. To research the background of deposit brokers who are not affiliated with an investment firm, start by contacting your state’s consumer protection office.

Cd Investment Options

Additional information

What Is A Bank Cd

Certificates of Deposit

Equity-Linked CDs

High-Yield CDs - Protect Your Money By Checking the Fine Print