The best way to go to Chase.com:

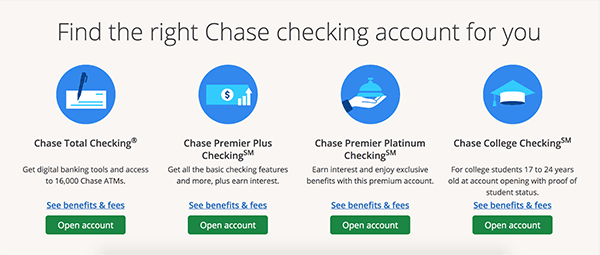

Chase Premier Savings account charges a $25 monthly fee. You can also often waive a monthly service fee by meeting certain requirements like a minimum account balance or setting up direct deposits. On average, despite the fact that all three banks charging monthly maintenance fees, Wells Fargo’s tend to be lower than those of the other two. How to get it: Open a new Chase Total Checking account and Chase savings account with at least $25 each by applying online or requesting an offer code by email to take into a local branch. Receive a direct deposit within 60 days of opening the checking account and you’ll get $300.

- Make sure your cookies are enabled. See our Online Privacy Policy to learn why we use cookies.

- Check your browser to see if you have the latest version.

Not sure what browser version you're using? Go to whatsmybrowser.org to get details about your current browser. Once you have this information, update your browser using the links above. - When updating your browser, consider this:

- Some features and functions may not operate properly with unsupported browser versions.

- We don't support beta or development browser versions. The browser has to be an officially released version.

- If you're using the latest officially released browser version, there might be a slight delay in our supporting this version as we must conduct testing to ensure it not only meets our strict security standards but also supports all our online features and enhancements.

- We don't support browsers in Compatibility Mode (this only applies to Internet Explorer).

- We don't support third-party browser extensions or plug-ins.

To avoid the $5 monthly service fee for the Chase Savings account, you will need a minimum daily balance of $300 or more, or at least one repeating automatic transfer of $25 or more from your personal Chase checking account (available only through Chase Online Banking). . Easy account management through Chase Business online and the Chase Mobile® app. Unlimited electronic deposits, ACH and Chase Quick Deposit SM. Convenient access to 16,000 ATMs and more than 4,700 branches. Search the world's information, including webpages, images, videos and more. Google has many special features to help you find exactly what you're looking for.

It’s never too early to begin saving. Talk with a banker at Chase Bankto see how CDs help you put money aside for a better future. You pick the term and earn a fixed rate of return on Chase Certificates of Deposits. You can choose a term as short as 1 month or as long as 120 months, with rates starting from 0.02% APY to as high as 0.90% APY. With a CD, you’ll always know exactly what interest rate you’ll receive during the term. And you can easily roll you CD over at the end of its term to keep your savings growing!

Chase CD rates are determined by your balance at the beginning of your CD term. Therefore, with a higher balance you can earn better interest rates. Footnote (Opens Overlay) The CD rate and term is fixed through the maturity date.

| CIT BANK CD TERM | RATE | LINK |

| 12-Month Term | 0.30% APY | Apply Now |

| 13-Month Term | 0.35% APY | Apply Now |

| 18-Month Term | 0.30% APY | Apply Now |

| 4-Year Term | 0.50% APY | Apply Now |

Table of Contents

Chase Bank CD Information:

- Apply Now

- Account Type: CD Account

- APY Rates: 0.02% – 0.90%

- Availability: Nationwide

- Locations: Nationwide (locator)

- CD Lengths: 1 – 120 months

- Credit Inquiry:Hard Pull or Soft Pull? Let us know.

- Opening Deposit: $1000

- Maximum Balance: $100,000

- Additional Requirements: None

- Early Withdrawal Penalties: A penalty will be imposed if you make a withdrawal of principal prior to the maturity date.

- Renewal Policy: Yes, you will have 10 days after maturity to withdraw or cancel the automatic renewal.

Chase Bank CD Terms:

Chase Cd Account

- 0.02% APY for a 1-Month CD

- 0.02% APY for a 2-Month CD

- 0.02% APY for a 3-Month CD

- 0.02% APY for a 6-Month CD

- 0.02% APY for a 9-Month CD

- 0.02% APY for a 12-Month CD

- 0.05% APY for a 15-Month CD

- 0.15% APY for a 18-Month CD

- 0.15% APY for a 21-Month CD

- 0.15% APY for a 24-Month CD

- 0.15% APY for a 30-Month CD

- 0.15% APY for a 36-Month CD

- 0.25% APY for a 42-Month CD

- 0.25% APY for a 48-Month CD

- 0.35% APY for a 60-Month CD

- 0.35% APY for a 84-Month CD

- 0.90% APY for a 120-Month CD

Why You Should Apply for This Account:

Easy to Open: If you have a personal Chase checking account, you can open your CD account online using your existing checking or savings account to fund your CD.

Peach of mind, at no extra charge: Like Chase savings accounts, CDs have the security of . The base coverage amount is $250,000 for each depositor for all combined deposits in the same bank. However, if you have joint and individual accounts, you and your spouse may be eligible for additional coverage.

Better Interest Rate: With a CD you commit the amount you want to save for a specified period of time and lock in your rate at account opening, but there are penalties for early withdrawal. CDs may come with the benefit of higher interest rates than our traditional savings accounts.

FDIC Insured: You can feel confident knowing that your funds are insured up to the maximum amount of $250,000.

Chase Cd Account

Bottom Line:

Chase Online Logon

Check out Chase Bank online CD accounts and earn interest rate up to 0.90% APY. With a low opening minimum deposit of $1,000 and no fees, you will definitely get a satisfying return on your investment. Keep in mind that you won’t be able to access your funds once you sign up. This is a great chance to invest in a high-interest CD account from Chase Bank. For investors looking to earn higher returns on longer CDs, you can find more of the Best CD Ratesin the country from the HMB list!

Disclaimer: Rates / APY terms above are current as of the date indicated. These quotes are from banks, credit unions and thrifts. Bank, thrift and credit union deposits are insured by the FDIC or NCUA. Contact the bank for the terms and conditions that may apply to you. Rates are subject to change without notice and may not be the same at all branches.

Chase Cd Account Rates

The Blue Cash Preferred® Card from American Express offers a $300 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months. You'll earn 6% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases (then 1%). 3% Cash Back at U.S. gas stations. 1% Cash Back on other purchases. In addition, you'll earn 6% Cash Back on select U.S. streaming subscriptions, 3% Cash Back on transit including taxis/rideshare, parking, tolls, trains, buses & more. The card does come with a $0 introductory annual fee for one year, then $95. (See Rates & Fees) |