- Ocbc Fixed Deposit Rate Malaysia 2021

- Ocbc Fixed Deposit Promotion Rate

- Ocbc Singapore Fixed Deposit Promotion

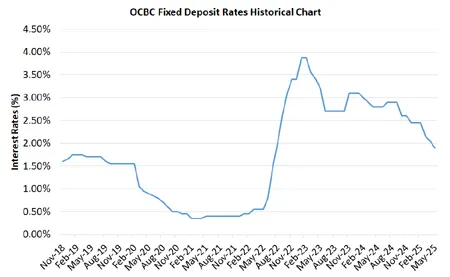

- Ocbc Fixed Deposit Interest Rate

Both local banks in Singapore such as DBS, OCBC, and UOB and foreign banks provide a fixed deposit (or time deposit, time saving, whichever term you prefer). The interest rates depend on the tenure and the total amount you’d like to place for the fixed deposit.

Ocbc Fixed Deposit Rate Malaysia 2021

What Is A Fixed Deposit Account? A Fixed Deposit account (FD) is a financial instrument offered by banks, which allows you to save your money for a fixed period of time to generate higher interest compared to a conventional savings account. In many western countries, FD is also known as term deposit or time deposit. The maximum placement amount for all the above Time Deposit promotions is S$999,999 or equivalent. For deposits above S$1 million, please contact us at 1800 363 3333 or visit any OCBC Bank branch.

Every bank has different tiered rates and more often than not these offers change frequently. So, instead of screen capturing those interest rates, we’ve collected the exact links too you can view a real-time interest rate at the top banks in Singapore.

When we say “top banks”, we mean “best interest rate” for the fixed deposit from our past observations. There’s no absolute winner here; if you’re serious for a fixed deposit soon, I suggest you visit these pages and do the quick comparison.

Fixed Deposit Interest Rates (Checklist)

We may not update the exact interests in time; so, always refer to these links as these banks usually provide good interest rates for the fixed deposit plans (Singapore Dollars; SGD) in Singapore:

- UOB: 0.7% for 12-month; 1.15% for 14-36 months

- OCBC: over a year 0.35%

- DBS: the best fixed deposit rate if you save for 18 months of less than S$50,000

- Maybank: 0.9% for 12-month; 1.15% for 24-month

- ICBC: 0.85%

- CIMB: 0.3% or 0.35% for S$100K and more

- Standard Chartered: 0.3% (online banking; minimum S$25K)

- HSBC: 0.3% (3 months)

UOB Fixed Deposit

e use of or reliance on the information provided herein.

| Deposit Range (% p.a) | Below S$50,000 | S$50,000 – S$249,999 | S$250,000 – S$499,999 | S$500,000 – S$999,999 |

| 1 Mth | 0.3000 | 0.3000 | 0.3000 | 0.3000 |

| 2 Mths | 0.3000 | 0.3000 | 0.3000 | 0.3000 |

| 3 Mths | 0.3000 | 0.3000 | 0.3000 | 0.3000 |

| 4 Mths | 0.3500 | 0.3500 | 0.3500 | 0.3500 |

| 5 Mths | 0.3500 | 0.3500 | 0.3500 | 0.3500 |

| 6 Mths | 0.3500 | 0.3500 | 0.3500 | 0.3500 |

| 7 Mths | 0.4000 | 0.4000 | 0.4000 | 0.4000 |

| 8 Mths | 0.4000 | 0.4000 | 0.4000 | 0.4000 |

| 9 Mths | 0.4000 | 0.4000 | 0.4000 | 0.4000 |

| 10 Mths | 0.4500 | 0.4500 | 0.4500 | 0.4500 |

| 11 Mths | 0.5500 | 0.5500 | 0.5500 | 0.5500 |

| 12 Mths | 0.7000 | 0.7000 | 0.7000 | 0.7000 |

| 13 Mths | 0.9000 | 0.9000 | 0.9000 | 0.9000 |

| 14 Mths | 1.1500 | 1.1500 | 1.1500 | 1.1500 |

| 15 Mths | 1.1500 | 1.1500 | 1.1500 | 1.1500 |

| 18 Mths | 1.1500 | 1.1500 | 1.1500 | 1.1500 |

| 24 Mths | 1.1500 | 1.1500 | 1.1500 | 1.1500 |

| 36 Mths | 1.1500 | 1.1500 | 1.1500 | 1.1500 |

OCBC Fixed Deposit

With effect from 6 June 2020, the interest rates for SGD Time Deposit with OCBC Bank will be revised as follows:

| S$5,000 – S$20,000 | >S$20,000 – S$50,000 | >S$50,000 – S$999,999 | ||||

| Tenure (months) | Prevailing rates (a year) | Rates from 6 June 2020 (a year) | Prevailing rates (a year) | Rates from 6 June 2020 (a year) | Prevailing rates (a year) | Rates from 6 June 2020 (a year) |

| 1 – 2 | 0.10% | 0.05% | 0.10% | 0.05% | 0.10% | 0.05% |

| 3 – 5 | 0.15% | 0.10% | 0.15% | 0.10% | 0.15% | 0.10% |

| 6 – 8 | 0.20% | 0.15% | 0.20% | 0.15% | 0.20% | 0.15% |

| 13 | 0.50% | 0.35% | 0.50% | 0.35% | 0.50% | 0.35% |

| 14 | 0.80% | 0.35% | 0.80% | 0.35% | 0.80% | 0.35% |

| 15 | 1.25% | same | 1.25% | 0.35% | 1.25% | 0.35% |

| 16 – 24 | 1.25% | 0.40% | 1.25% | 0.40% | 1.25% | 0.40% |

| 36 | 1.55% | same | 1.55% | 0.40% | 1.55% | 0.40% |

| 48 | 1.95% | same | 1.95% | 0.40% | NA | NA |

The revised rates will apply to new and renewed placements from 6 June 2020.

DBS Fixed Deposit

Effective Date: 17/07/2020

| Period | $1,000 – $9,999 | $10,000 – $19,999 | $20,000 – $49,999 | $50,000 – $99,999 | $100,000 – $249,999 | $250,000 – $499,999 | $500,000 – $999,999 |

|---|---|---|---|---|---|---|---|

| 1 mth | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 2 mths | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 3 mths | 0.1500 | 0.1500 | 0.1500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 4 mths | 0.1500 | 0.1500 | 0.1500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 5 mths | 0.1500 | 0.1500 | 0.1500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 6 mths | 0.2000 | 0.2000 | 0.2000 | 0.1000 | 0.1000 | 0.1000 | 0.1000 |

| 7 mths | 0.4000 | 0.4000 | 0.4000 | 0.1000 | 0.1000 | 0.1000 | 0.1000 |

| 8 mths | 0.6000 | 0.6000 | 0.6000 | 0.1000 | 0.1000 | 0.1000 | 0.1000 |

| 9 mths | 0.9500 | 0.9500 | 0.9500 | 0.1000 | 0.1000 | 0.1000 | 0.1000 |

| 10 mths | 1.1000 | 1.1000 | 1.1000 | 0.1000 | 0.1000 | 0.1000 | 0.1000 |

| 11 mths | 1.1000 | 1.1000 | 1.1000 | 0.1000 | 0.1000 | 0.1000 | 0.1000 |

| 12 mths | 1.1500 | 1.1500 | 1.1500 | 0.1500 | 0.1500 | 0.1500 | 0.1500 |

| 18 mths | 1.3000 | 1.3000 | 1.3000 | 0.1500 | 0.1500 | 0.1500 | 0.1500 |

| 24 mths | 0.9000 | 0.9000 | 0.9000 | 0.1500 | 0.1500 | 0.1500 | 0.1500 |

| 36 mths | 0.8500 | 0.8500 | 0.8500 | 0.1500 | 0.1500 | 0.1500 | 0.1500 |

| 48 mths | 0.7500 | 0.7500 | 0.7500 | 0.1500 | 0.1500 | 0.1500 | 0.1500 |

| 60 mths | 0.7500 | 0.7500 | 0.7500 | 0.1500 | 0.1500 | 0.1500 | 0.1500 |

Ocbc Fixed Deposit Promotion Rate

Interest rates are indicative. Rates apply to individual accounts only.

ICBC Fixed Deposit

SGD Fixed Deposit promotional interest rate (applicable to deposits of Fresh Funds with a minimum amount of S$500)

| SGD | Promotion Rates (for Fresh Funds) | |

| Over the Counter | Via E-Banking | |

| Tenor | SGD500& Above | SGD500& Above |

| 1 month | 0.25% | 0.30% |

| 3 months | 0.45% | 0.50% |

| 6 months | 0.55% | 0.60% |

| 9 months | 0.70% | 0.75% |

| 1 year | 0.80% | 0.85% |

CIMB SGD Fixed Deposit Rates

| Tenure (Months) | Board Rates (% p.a.) S$1,000 – $99,999 | Board Rates (% p.a.) S$100,000 & Above |

|---|---|---|

| 1* | 0.20 | 0.20 |

| 2* | 0.25 | 0.30 |

| 3 | 0.30 | 0.35 |

| 6 | 0.30 | 0.35 |

| 9 | 0.30 | 0.35 |

| 12 | 0.30 | 0.35 |

| 24 | 0.30 | 0.35 |

More Singapore Tips

Updated OCT 2020

OCBC Fixed Deposit Interest Rate

Ocbc Singapore Fixed Deposit Promotion

| Tenure(Months) | Board Rate (%) S$5,000 – S$20,000 | Board Rate (%) >S$20,000 – S$50,000 | Board Rate (%) >S$50,000 – S$99,999 | Board Rate (%) S$100,000 – S$249,999 | Board Rate (%) S$250,000 – S$499,999 | Board Rate (%) S$500,000 – S$999,999 |

| 1 to 2 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 |

| 3 to 5 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 |

| 6 to 8 | 0.15 | 0.15 | 0.15 | 0.15 | 0.15 | 0.15 |

| 9 to 12 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 |

| 13 to 14 | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 |

| 15 | 1.25 | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 |

| 16 to 24 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 |

| 36 | 1.55 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 |

| 48 | 1.95 | 0.40 | NA | NA | NA | NA |